E-Mini S&P500 Ahead Of NFPTop ↑

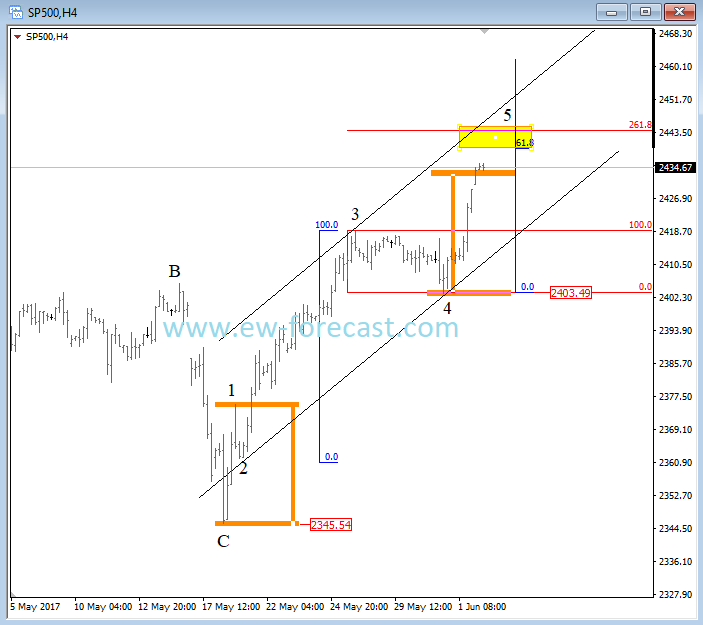

June 02 2017 S&P500 is trading at all time highs with some sharp price move up from 2403 that we see it as fifth wave rally; final part of a five wave recovery from 2345, called an impulse wave*. There are some Fibonacci levels around 2440 that may play out an important roll for the next few sessions, as we think that upside can be limited and that new corrective set-back can be coming at the start of June. However, extended fifth waves are very common on stock markets, so do not chase it and call a top until you see a five wave drop from the high.

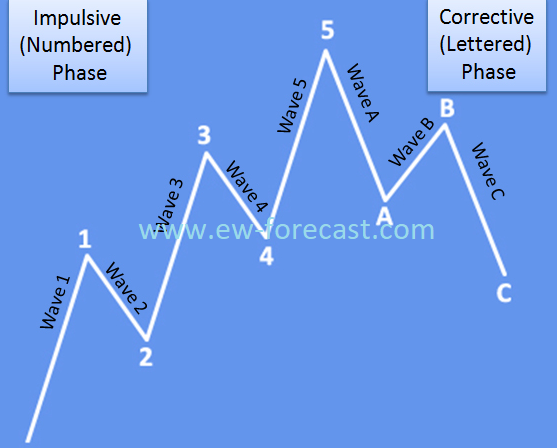

__________ *Impulse wave is structured by five subwaves in the direction of a stronger trend. The picture below shows a five wave move to the upside, meaning that price is in uptrend. When five move is complete you can expect a three wave set-back.

Newsletter archive

|

New York time: 00:00:00

Local time: 00:00:00

| E-mail: | |

HOME

MEMBERS

SERVICE

NEWSLETTER

ELLIOTT SCHOOL

CONTACT

©2010 - 2020 ew-forecast.com

Design: VOBI